The 130% super-deduction is the business equivalent to the highly successful Eat out to Help out scheme the government ran.

You’ve probably taken a lot of card payments this year through click and collect and delivery orders. This also means you would have recorded a large number of sales for the year. Rather than paying some of this to the government, you can claim up to 130% on new machinery for your fish and chip shop – Something worth looking into.

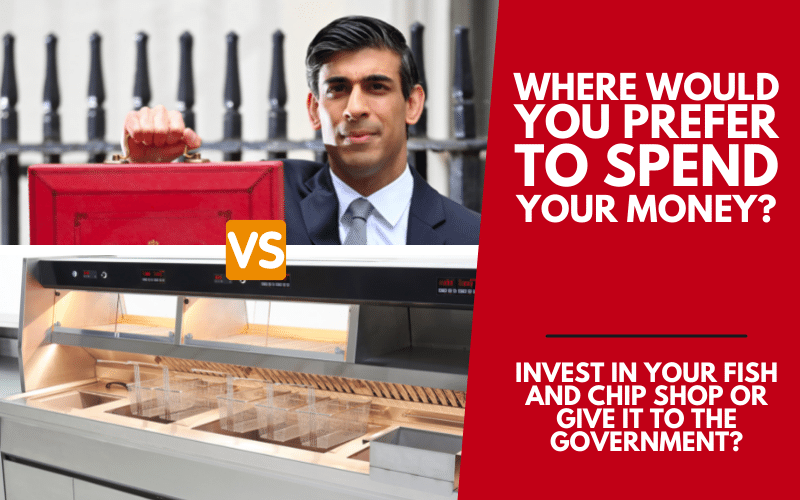

So, the question you should be asking yourself is, do you want to give your money to Rishi or invest it in a new range or machinery for your shop?

This super deduction provides an allowance of 130% on most new plant and machinery investments that would normally qualify for 18% main rate writing down allowances.

So, on a £30,000 range, you’ll be able to claim £39,000 which is a saving of £7,410 against corporation tax. In theory, that means the range only costs you £22,590. This super deduction applies to limited companies for purchases up to March 2023. In order to qualify you’ll need to record it before the end of your financial year as the 130% tax deduction is against any capital expenditure.

For more information, we strongly recommend that you speak to your accountant or visit the government website here.

Can I claim the super-deduction if I use finance?

The 130% tax break excludes hire purchase or asset finance arrangements and is only eligible to the person to whom the equipment is bailed or hired who incurs the expense.

Can I use the super-deduction to buy used equipment?

In short, no. This excludes used equipment.

Get in touch

Call a member of our friendly team on 01527 592 000 to discuss your range requirements and for us to send you a quote straight to your inbox.

Recent Comments